Schneiderman Insurance Agency, Inc. Blog

|

|

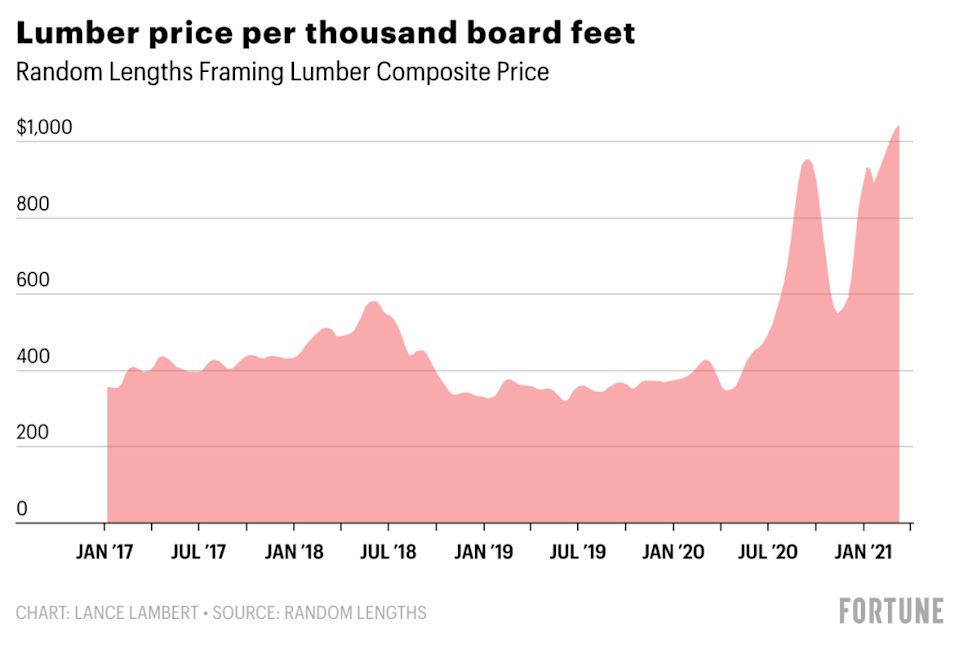

The costs of home construction are increasing even in the pandemic. The two most important factors that have caused these price surges are the increased demand for lumber and other raw material use in house construction and the shortage of material. Essentially both supply and demand are being impacted at the same time. Increased Cost of Home ConstructionAccording to Random Lengths, the prices of softwood lumbers have increased about 112% over the last year. These abrupt changes in the cost of lumber and other house construction material are due to the increasing demand for single-family homes, low-interest rates, and the increasing trend of renovating your house during the free time in lockdown as a result of COVID-19. This significant increase in the prices of lumber is due to the boom in home construction contracts. A report of Census Beaurea Data has shown that in July 2020 a rise of 20% in residential construction contracts has been seen when compared to the construction contracts in June. The other reasons for this increased cost can be the fact the lumber industry has been shut down for a significant time during the Covid-19 pandemic and when the industries are opened again the overwhelming demand for lumber due to increase house construction and DIY projects has caused the shortage of the lumber and hence the surge in the lumber prices. And with the increasing rate of new construction, it is hard to find skilled labor and if somehow you managed to get a skillful person who knows his work, there are high chances that their wages are out of your budget. All these factors have contributed to this sharp increase in the price of home construction and we don’t see these prices go down in 2021 and even at the start of 2022. Importance of Reviewing Your Homeowners Insurance Replacement Cost EstimateThe increased prices of construction materials have also affected the cost of homeowners insurance because of the increased replacement cost of the house. Replacement cost is the cost that would be needed to rebuild your house to its current state. Many people misunderstood it for the current market value of the home or the mortgage amount, but it is different. If your home insurance covers the replacement cost, your insurance company will cover the expenses to rebuild your home up to the value that is listed in your policy limit. So if you fail to calculate the adequate replacement cost, there are high chances you will end up underinsuring your house. And if any catastrophic event happens and damages your home, the reconstruction can cost you hundreds of thousands of dollars due to high construction prices and can leave you and your family in a state of limbo if you don’t have enough coverage. While many homeowners insurance policies have and extended replacement cost endorsement allowing for demand surges that affect reconstruction costs, major shifts in pricing such as what is happening with lumber costs currently may not be accounted for and would need an adjustment to the dwelling limit on the homeowners insurance policy itself. How Replacement Cost affects the Cost of Homeowner Insurance?The replacement cost is one of the main factors that directly affect the cost of your homeowner's insurance. If the price of construction material is low, less money will be required to build your house. But these days that’s not the situation the price of construction material is touching the skies and obviously rebuilding your house will also need more money than ever. So the replacement costs of houses are high and increasing the amount of coverage you would need to rebuild your home and therefor increasing the cost of your homeowners insurance policy. How Your Insurance Agent Can Help You In Determining Updated Replacement Cost?An experienced insurance agent can help you big time in calculating the right coverage you will need by keeping in view the trends in the rise of the price of construction material and will make sure that your insurance is giving you the right coverage in an emergency. While calculating the replacement cost of your house, your insurance agent will keep the following factors into account:

Your insurance agent should have a replacement cost estimate tool with updated costs specific to your location. There’s no better time that now to review the replacement cost estimate with your insurance agent and make sure they have the right details for your home. If after a thorough review of the cost estimate you determine more coverage is needed your agent can make an adjustment to assure your homeowners insurance is up to date based on the inflating costs of construction. Wrapping UpDuring these unexpected surges in the price of construction material, the calculation of replacement cost and the right coverage for your homeowner's insurance is essential. But having a good ongoing relationship with a credible insurance agent can help you big time in the hour of need. An experienced insurance agent will calculate the right coverage for its client and help them in saving their biggest investment i.e, their house.

1 Comment

12/12/2022 07:42:15 am

Last week, I talked with my sister about how she's buying a house with her husband, and they want to get it insured before moving into it. It's helpful to know that we must review our insurance replacement cost policy before agreeing to that insurance plan, so we'll definitely keep it in mind. We appreciate your advice on how we'd avoid financial debt by calculating our insurance replacement cost in time.

Reply

Leave a Reply. |

Contact Us(818) 322-4744 Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed